- Hadeed will also acquire a 100 per cent shareholding in Rajhi Steel

Saudi Arabia’s Public Investment Fund will fully acquire the Saudi Iron & Steel Company (Hadeed) from Saudi Basic Industries Corporation (Sabic) in a 12.5 billion Saudi riyals ($3.3 billion) deal, as the kingdom seeks to accelerate its industrial development.

The deal is expected to close before the end of the first quarter of 2024, Sabic, the Middle East’s biggest petrochemicals company, said on Sunday in a bourse filing to the Tadawul stock exchange.

The final sales price will be disclosed at the closing date, Sabic said.

Under a cross-conditional share exchange agreement, Hadeed will also acquire a 100 per cent shareholding in Al Rajhi Steel Industries Company (Rajhi Steel) from Mohammed Abdulaziz Al Rajhi & Sons Investment Company (Rajhi Invest), in exchange for newly issued shares in Hadeed, the PIF said in a statement on Sunday.

PIF and Rajhi Invest’s final shareholding in Hadeed will be subject to the closing mechanics set in the agreements.

“These transactions will bring together PIF’s financial capabilities and industry experience with Hadeed and Rajhi Steel’s leading technical and commercial expertise, to create a national champion in Saudi Arabia’s steel sector,” Yazeed Al Humied, deputy governor and head of Middle East and North Africa Investments at PIF, said.

The deals are in line with the PIF’s wider efforts to develop the local industrial sector and to establish strategic partnerships that boost the private sector’s economic contribution.

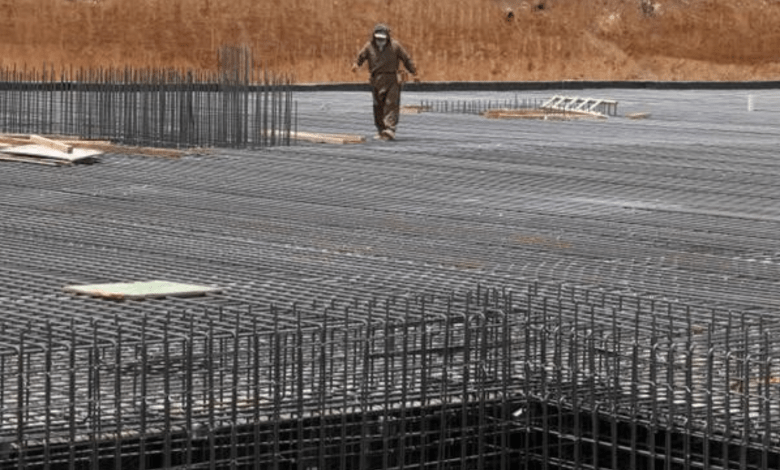

The agreements will help to meeting the growing local demand for steel and improving Saudi Arabia’s steel production capabilities, according to the statement.

They will also contribute towards the growth of downstream sectors such as local construction, automotive, utilities, renewables, transport and logistics.

Saudi Arabia, the Arab world’s largest economy, is expanding its industrial, manufacturing and mining sectors as part of its Vision 2030 strategy that aims to reduce its reliance on oil revenue and diversify its economy.

In May, Saudi Aramco, the world’s largest oil-producing company, the PIF and China’s Baoshan Iron and Steel signed an agreement to build the kingdom’s first steel plate manufacturing complex.

The complex is forecast to have an annual production capacity of up to 1.5 million tonnes and will be built in Ras Al Khair Industrial City, one of the four new special economic zones recently announced by Saudi Crown Prince Mohammed bin Salman.

Last year, the kingdom set out plans to build three iron and steel projects worth 35 billion riyals, with a combined production capacity of 6.2 million tonnes, as part of Vision 2030.

Sabic said proceeds from the sale of its Hadeed will be used to reinforce its growth in the chemicals industry, according to its bourse filing.

The deal will help Sabic optimise its portfolio and focus on its core business, it said.

The fair valuation of Hadeed’s net assets is expected to result in a non-cash loss of 2 billion to 2.5 billion riyals in Sabic’s third-quarter earnings.

“We realise that Hadeed has further potential to become one of the most significant iron and steel companies in the GCC region,” Abdulrahman Al Fageeh, chief executive of Sabic, said.

“For Sabic, it was therefore important that the right buyers be found to enable Hadeed to achieve its full potential. The sale of Hadeed will enable Sabic to focus meanwhile on its strategy to become the preferred world leader in chemicals.”

The deals are in line with PIF’s wider strategy to develop 13 strategic sectors, including metals and mining, as part of the kingdom’s economic diversification strategy.

The fund has been involved in a broad range of projects in sectors including aviation, tourism, sports, gaming, camel milk, pharmaceuticals and cars.